Data: The Rising Tide of Medical Debt

As correspondent Jennifer London reports in our segment "Your Money or Your Life," the rising cost of medical care has forced many more people to make difficult, even life-changing decisions. When you look at the numbers, it's not hard to see why.

As of 2007, more than 2.2 million Californians reported having medical debt. Of those, about two-thirds also carried health insurance. And the problem is only getting worse, according to Gwendolyn Driscoll of the UCLA Center for Health Policy Research. She says a new report due out at the end of January will show that the number of people saddled with medical debt has risen since their last report in 2009.

Some counties with smaller populations have been grouped. In these cases, the percent and population totals that appear for each county actually represent the combined total for the group. Group One: Del Norte, Siskiyou, Lassen, Trinity, Modoc, Plumas, Sierra. Group Two: Tehama, Glenn, Colusa. Group Three: Tuolomne, Inyo, Calaveras, Amador, Mariposa, Mono, Alpine. Source: 2007 California Health Interview Survey, UCLA

Humboldt County is the hardest hit, with 39 percent of the adult population carrying medical debt. Los Angeles County actually shows up low on the list, with only 11 percent in debt. (Click the map to interact.)

Medical debt can have serious, if unintended, consequences. In 2010, about 75 million adults skipped treatments, opted not to fill prescriptions and otherwise did not get needed health care because of the cost, according to The Commonwealth Fund.

More than half of those with medical debt reported experiencing financial trouble as a result, according to the 2007 California Health Interview Survey. Many of them reported taking out loans, dipping into savings, or being unable to pay for basics, and a few even reported having to declare bankruptcy.

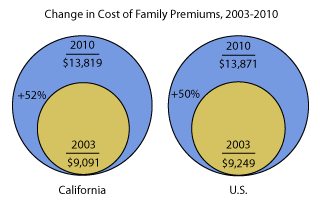

The reason for the rising debt? The following charts begin to illustrate what's at work.

Health insurance premiums have been on the rise for years. From 2003 to 2010, they represented an ever-increasing share of individual income. For example, in California in 2003, premiums consumed about 15 percent of the median family income. By 2010, the share had increased to more than 22 percent.

Making matters worse, as those insurance premiums go up, so in many cases do the out-of-pocket expenses for care.

The Affordable Care Act of 2010 is expected to bring some relief, though many observers are saying much more will be needed to contain the spiraling costs of medical coverage in this country.

The White House has a fairly straightforward timeline of health care reforms that will be rolling out over the next few years. You can view it here.